About Deadline Extended to Claim the Employee Retention Tax Credit

Everything about New IRS Guidance for ERTC in 2021's Q1 + Q2 - NGCOA

To find out more, companies need to describe instructions for the applicable tax return. Failure to pay charges might result if repayments are not made according to these specific specifications. For PEO/CPEO customers who had employment tax deposits decreased, as well as received advance payments by submitting Form 7200, they will need to pay back these under their PEO/CPEO accounts.

U.STreasury Department Experts Explain Updates to the ERTC

The IRS published guidance to clarify how it would work. If a qualified employer uses a PEO or CPEO, the retention credit is reported on the PEO/CPEO aggerate Kind 941 and Set up R. Looking forward If companies have questions or require more info, they must work with their accountant and payroll professional.

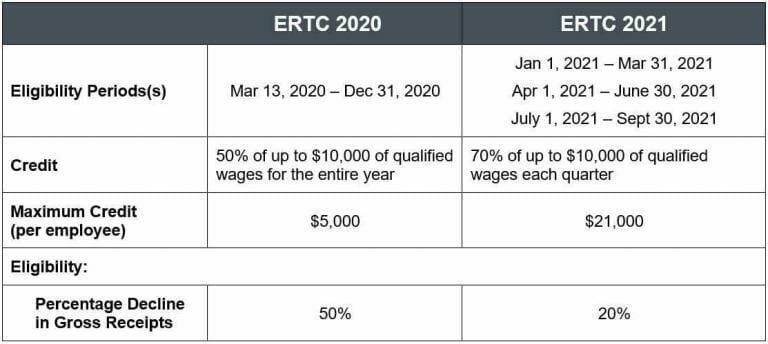

With numerous American businesses around the nation struggling due to the COVID-19 pandemic, the U.S. government responded by passing multiple stimulus bundles and tax credits throughout 2020 and now into 2021. One necessary tax credit services must know is the Staff Member Retention Tax Credit (ERTC) which has now been extended through 2021 at a possible value of as much as $26,000 per staff member.

70% Employee Retention Tax Credit [$28,000 Per Employee 2021 ERTC] What is 20% Gross Receipts Test? - YouTube

Our Bill would reinstate fourth quarter of Employee Retention Tax PDFs

Among many modifications and updates to the previous relief legislation for COVID-19, this law clarifies and expands the Staff member Retention Tax Credit (ERTC) that was created by the CARES Act established in March of 2020. Among the larger changes in the law is that the Staff Member Retention Tax Credit (ERTC) is now offered for employers who formerly got, or will receive, an Income Defense Program(PPP) loan.

WEBINAR: Employee Retention Credit (ERC) on Vimeo

And The American Rescue Strategy Act, signed into law by President Biden in March, 2021, extends the credit, which had been set to expire in June, 2020, to the first 3 quarters of 2021. The Worker Retention Tax Credit (ERTC), another portion of the CARES Act, was developed to incentivize organizations to keep staff members on their payroll during the COVID-19 pandemic.

Companies that were not out there in 2019 might use a contrast to 2020 for functions of the credit. Starting Research It Here , 2021, the credit will be offered to businesses with operations that are either completely or partly suspended by a COVID-19 governmental order throughout the period the order is in force; or gross receipts are minimized by a minimum of 20% (to put it simply, the invoices were less than 80% of gross invoices) for the same quarter in 2019.